Get the free excel mortgage statement template

Get, Create, Make and Sign mortgage billing statement example form

How to edit mortgage statement pdf online

How to fill out fillable mortgage statement form

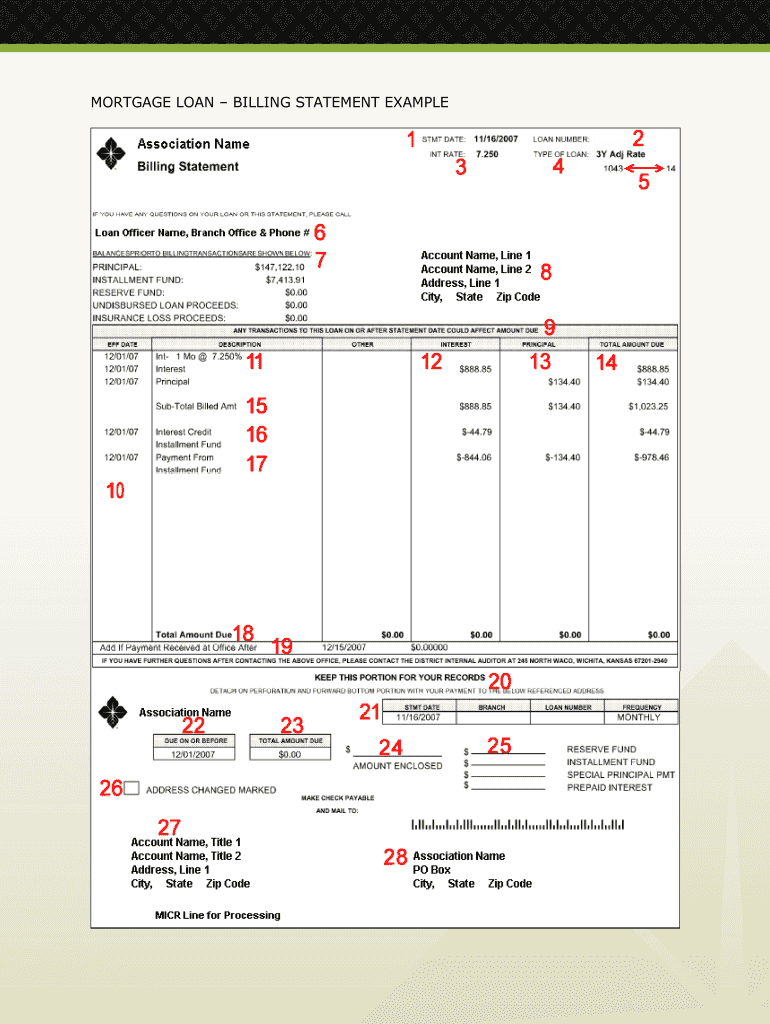

How to fill out Mortgage Loan Billing Statement Example

Who needs Mortgage Loan Billing Statement Example?

Video instructions and help with filling out and completing excel mortgage statement template

Instructions and Help about mortgage statement template

Okay so one of the biggest misconceptions is new buyers understanding really what the tax benefits the means of being able to write off the interest on a home so let's put a quick example together for you here let's make a couple assumptions let's first make the assumption you're buying a $350,000 house, and you're putting 5% downs that means you're financing three hundred and thirty-two thousand five hundred and let's just say five and a quarter percent interest, so that makes your payment 1836 a month that's principal and interest but of that 1836 1450 for that each month is going towards interest, so annually it's about 17 thousand 456 you'd pay an interest per year for this home under this example okay so let's take another gumption is to say your household incomes about eighty thousand and let's say you're in the twenty-eight percent tax bracket so other than other deductions that you have your annual tax bills about twenty-two thousand four hundred per year that you're obligated to pay in taxes before any deductions so in this case you have an interest write-off because you paid seventeen thousand 456 an interest for your home that actually makes your taxable income sixty-two thousand five forty-four, so literally your taxable income can straight off the top of that interest write-off so instead of being taxed at eighty thousand you're not being taxed at sixty-two five forty-four now at twenty-eight percent of that equals seventeen thousand five twelve per year you owe in taxes, so that's an annual savings of about forty-eight seventy-seven, so literally you get back in taxes or pay less in taxes of forty-eight hundred dollars 48 seventy-seven in this example that averages out to be about 407 per month, so you can see owning a home and paying interest on a mortgage is a huge tax benefit now a lot of people really don't understand how it works, so hopefully this has cleared that up a little for you

What is mortgage statement?

People Also Ask about create mortgage statement

How do I get a copy of my mortgage statement?

What is included in a mortgage statement?

What is a mortgage document called?

What is a mortgage statement?

How do I write a mortgage statement?

What is a mortgage statement called?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortgage statement generator for eSignature?

How do I complete example mortgage statement online?

How do I edit monthly loan statement template straight from my smartphone?

What is Mortgage Loan Billing Statement Example?

Who is required to file Mortgage Loan Billing Statement Example?

How to fill out Mortgage Loan Billing Statement Example?

What is the purpose of Mortgage Loan Billing Statement Example?

What information must be reported on Mortgage Loan Billing Statement Example?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.